Florida citrus growers remain interested in diversifying their planting portfolio and continue to question whether lemons should be a consideration. Anyone navigating back roads in primary Florida citrus production areas has certainly seen significant lemon acreage going in the ground. The trees have a distinctive appearance and really catch the eye. Much of the interest was initially driven by HLB tolerance of lemon varieties, but lemon plantings also helped fill capacity and market demand. The lemon story is too complex to cover in one edition of this column, but we’ll illuminate the big picture and perhaps generate interest in further analysis.

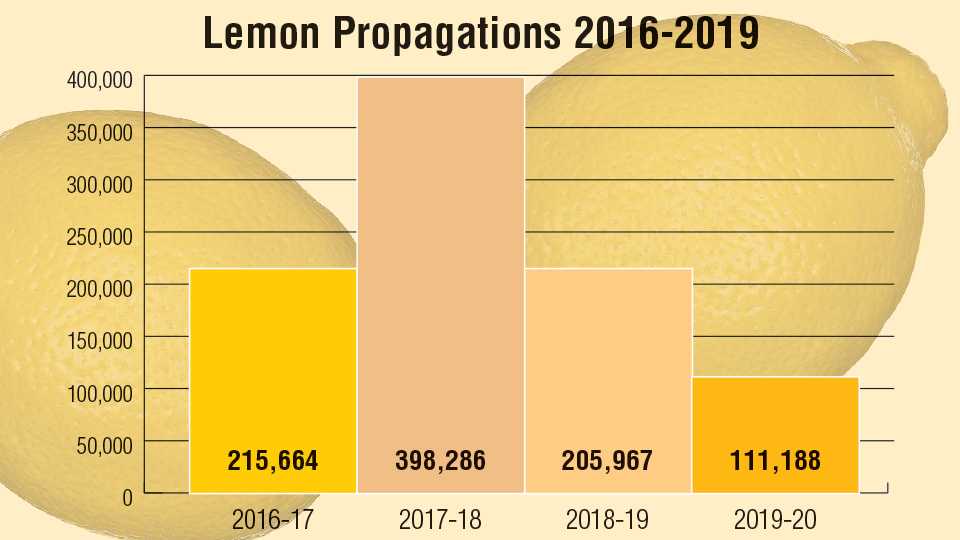

In the graphic below are Florida lemon propagations for the past four years as reported by Florida Department of Citrus-Division of Plant Industry Bureau of Citrus Budwood Registration. Lemon planting densities are typically lower than for oranges or specialty citrus. If we assume 130 trees per acre, this would account for approximately 7,161-acre equivalents, with more than 3,000-acre equivalents produced in 2017-2018.

At 150 trees per acre, the total would be 6,206-acre equivalents, with 2,655 in 2017-2018. Not all of the lemons planted were for processing, but the vast majority certainly were. The estimate for grafted dooryard propagations during this time is 100,000 to 150,000 trees (included in these numbers), and a significant number of dooryard lemon trees are produced each year from cuttings.

Industry estimates of planted lemon acreage lag behind official propagation figures, possibly due to planting delays or delayed reporting of new acreage. One thing is clear — St. Lucie County has the most acreage, followed by Hendry.

Varieties of Florida lemons planted seems to have settled out. ‘Harvey’ lemon had its day in 2016-2017 but has dropped off since then. The most popular variety for processing remains the ‘Bearss’ lemon, followed by ‘Eureka’, and ‘Lisbon’ is a distant third. ‘Eureka’ is the most popular for fresh packing. The ‘Meyer’, considered a hybrid, is propagated for the fresh market. Graphic courtesy of FDACS-DPI Bureau of Citrus Budwood Registration

Market Considerations

I reached out to a group of experts for some reconnaissance on the situation. There is currently an oversupply of lemons worldwide. It is clear that Florida cannot compete with Argentina and Mexico in the concentrate market. Not from concentrate (NFC) and oil are the name of the game for Florida. A quick examination of the lemon propagation data seems to indicate that Florida may have enough lemons in the ground to satisfy current processing demand. The X factor is the oil market. If demand for lemon oil increases, acreage may expand. There is one dominant player in the NFC juice and oil markets, and several secondary brands. It’s a difficult market to anticipate.

How does all of this add up for growers? Several sources concurred that growers would be wise to have processor/brand, multi-year commitments before planting lemons. Lemons can be lucrative, but there are a myriad of factors that introduce risk into the equations. First, there is a limited maturity and processing window.

Second, unless growers can share in the value-added NFC and oil recovery revenue stream, they are at the mercy of a cash market in a short market window. This is not a favorable position from which to negotiate. Florida’s favorable proximity to key consumption markets certainly fuels the value proposition with savings in freight, much like with orange processing.

Fresh Market?

Growers can explore some combination of the fresh and processed lemon markets, but the short maturity window, harvesting challenges during peak rainfall months, and the narrow market window between larger-competing, arid climate production areas make this tricky. Florida growers would be wise to seek the counsel of an experienced packer and marketer before launching into the fresh lemon market.

Fresh market expertise estimates there is room to expand Florida’s lemon position with adequate marketing support. The market may be able to support another 500 to 1,000 Florida lemon acres. The challenge remains getting retail supermarket chains to accept Florida’s “tropical look.” Lemons, like other citrus varieties, are subject to wind-scar and oil spotting. Considering that consumers are trending toward local and domestic production, and a greater tolerance of fruit in its natural state, there may be conservative opportunity.

Special Note from the UF/IFAS Citrus Plant Improvement Team, CREC, Lake Alfred

The University of Florida Citrus Research and Education Center breeding program has been working to develop new lemon varieties that would be of greater value to growers and to the industry. An initial goal was to have Florida lemons with increased peel oil production, to support the lucrative lemon by-product industry. Along the way toward that goal, we identified some selections that not only produce more oil but also produce fruit that nearly have any seeds at all — a characteristic of increasing importance to the fresh-lemon business.

We also have seen differences in peel thickness, with thinner-peeled lemons producing greater percentages of juice. A very large, long-term field trial — containing more than 40 of our advanced selections — has been underway in South America, and we are collecting a lot of data on performance so we might identify the best selections for release. But more importantly to Florida growers, we have some trials with collaborating growers to determine the best options for us here in the Sunshine State, looking at multi-purpose cultivars that can be of value to the fresh market as well as to the processing business. Based on these trials, we’ll soon be making decisions on those we feel will best serve the needs of the Florida citrus industry.