Up Front

By Frank Giles

This spring, we asked specialty crop growers to take a survey touching on various topics. We published some of the highlights from the survey in last month’s issue of the magazine.

One thing the survey illustrated is the huge diversity of the fruit and vegetable sector in the Southeast. There are literally hundreds of crops that are grown in this category.

From a pure data-collection standpoint, with growers who produce so many crops, the survey results were a bit all over the place. But a few trends rose to the top.

H-2A Hardships

Among them was concern over labor. We’ve covered this issue many times and will continue to do so. When it comes to labor, most growers pointed to the high cost of using the H-2A visa program and its adverse effect wage rate (AEWR).

The AEWR has jumped by double-digit percentage points in some southern states in recent years. Often, growers are not informed of the increased costs until after they’ve made planting decisions for the coming year.

Labor is a continuing problem, and programs like H-2A are critical to ensure producers have the workforce to grow and harvest their crops. Improvements need to be made to the program. Some survey respondents suggested moving H-2A under the U.S. Department of Agriculture (USDA), where it could be more responsive to growers’ needs.

Access to Capital

Not far behind labor, growers flagged access to operating capital as another major concern. This is something we’ve written less about but will begin diving deeper into the issue.

Following quite a few farmers on social media, I’ve seen comments about this problem increasing in the past couple of years. This is a challenge for all of agriculture, not just specialty crop growers.

According to the 2023 Ag Lenders Survey by the American Bankers Association, liquidity was listed as the top concern for farm lenders, driven by rising interest rates (operating loans cost 43% more in 2023 than in 2022) and high input costs. As working capital depletes, farmers struggle to renew annual operating loans. This often forces them to rely on longer-term debt secured by property, thus increasing the risk of foreclosures if equity runs out.

Farmers’ debt continues to grow. According to USDA, it has reached historic highs, with total farm debt estimated at $561.8 billion in 2025, up 3.7% from 2024.

Tracking Tariffs

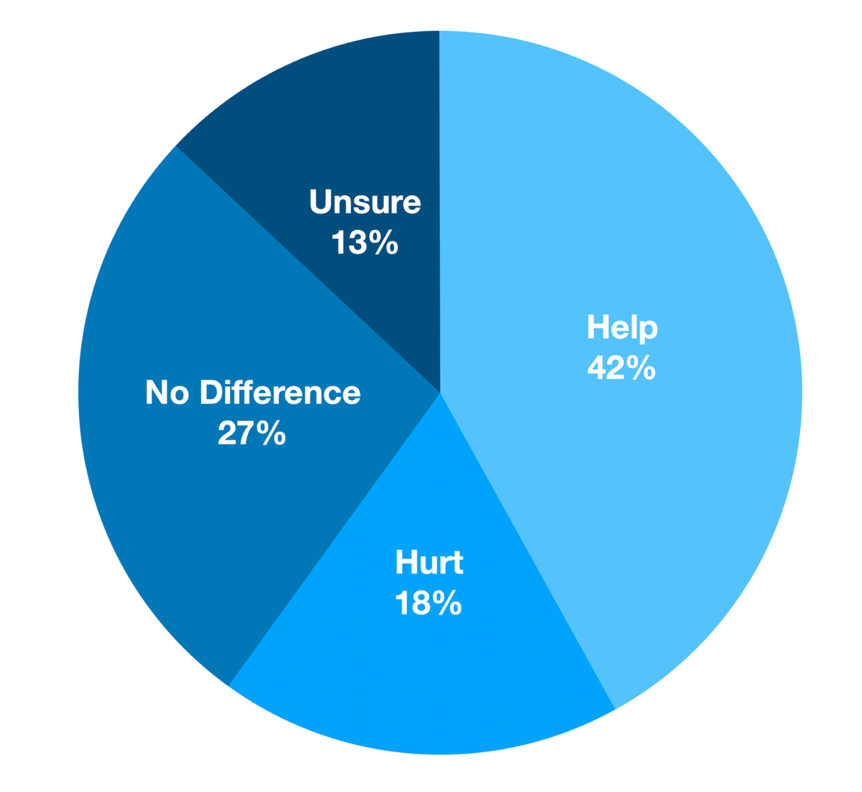

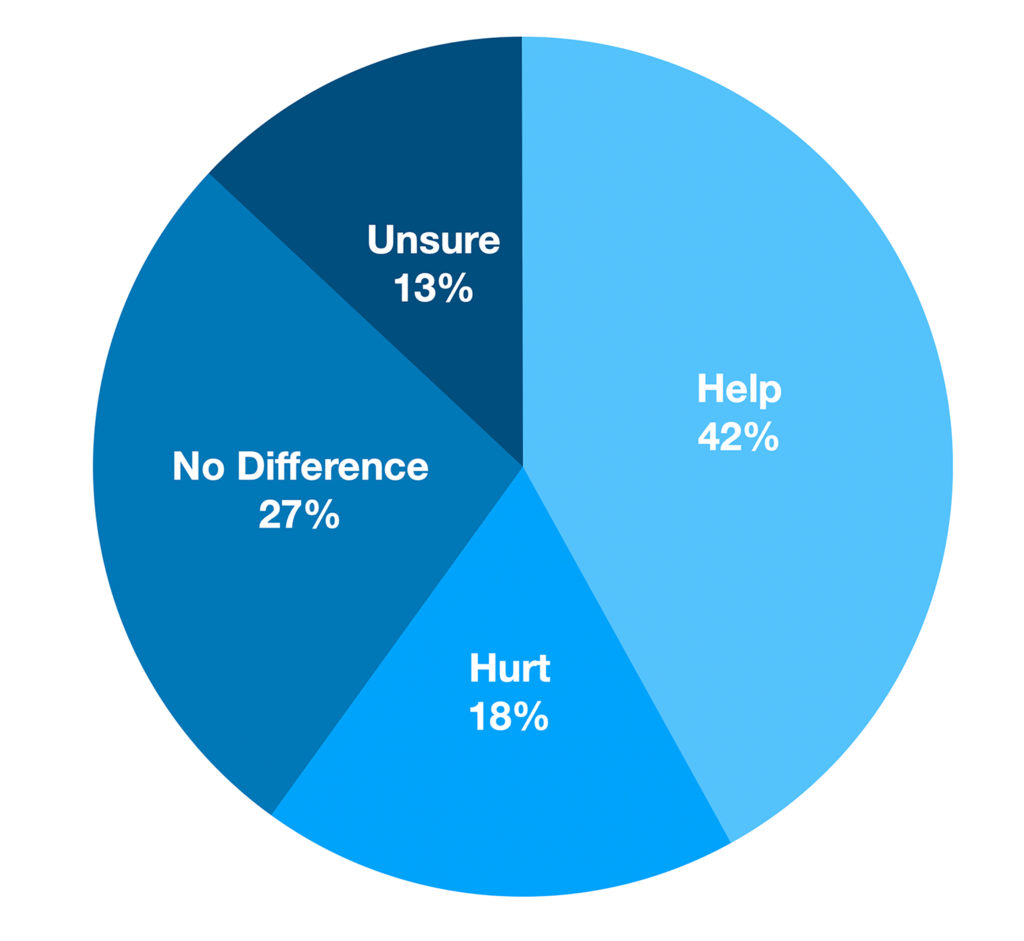

We also asked specialty crop growers if tariffs were going to hurt, help or make no difference in their businesses. The data was a little easier to interpret on this topic. However, the news on tariffs is changing almost daily, or at least it was when the survey was conducted.

Forty-two percent of specialty crop growers surveyed believe tariffs will help them. I suspect this might have been spurred by the thought that tariffs could help stem the flow of exports into the United States from places like Mexico. Tomatoes, for instance, came to mind. But it was learned later that tomatoes were exempt from tariffs under the U.S.-Mexico-Canada trade agreement. However, that didn’t stop Mexican exporters from flooding the U.S. market for a short time to beat any tariffs that might be imposed.

The dust has since settled, and U.S. tomato growers scored a victory in getting the U.S. Department of Commerce to terminate the suspension agreement on fresh tomatoes between the United States and Mexico. The industry had been fighting for this for years.

Much at Stake

Whether it’s labor, farm finances or trade, these are challenges we have to address as a nation from the president and policy makers to the American people. We must have an environment where small and large farms can survive and thrive. We have to get this right because our food security and national security depend upon it.