By Frank Giles

The global blueberry market has been evolving over the past 20 years. The fruit has grown in popularity with consumers worldwide. This is a good thing, but it has presented challenges for growers in the Southeast as increased production across the globe competes to supply the demand.

Zhengfei Guan, associate professor of economics with the University of Florida Institute of Food and Agricultural Sciences, has been following the blueberry market closely.

Photo courtesy of Kyle Hill

“Blueberries have surged in popularity worldwide,” Guan said. “Over the past 15 years, global blueberry production has more than tripled, rising from around 850 million pounds in 2010 to about 2.7 billion pounds in 2023, which is the most recent data available.”

Top Producers

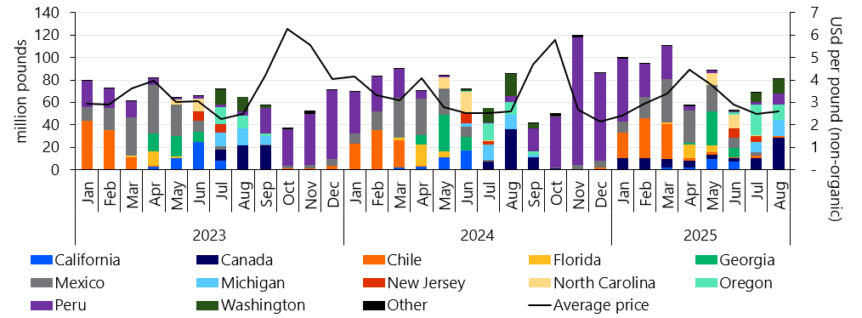

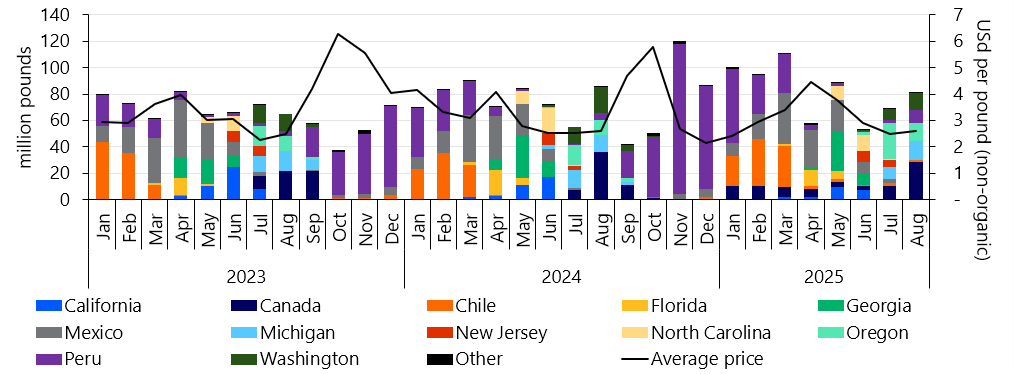

The United States produces over 700 million pounds of blueberries and has been the largest blueberry producer in the world, followed by Peru, Canada, Chile and Mexico. Peru and Mexico have been the fastest-growing producers in the world.

“Peruvian production has skyrocketed in recent years, surging from 23 million pounds in 2015 to a record high of nearly 650 million pounds in 2022, increasing 28-fold in less than 10 years,” Guan said. “Mexican production also witnessed exponential growth. Its production in 2015 was less than 35 million pounds, but it jumped to about 180 million pounds in 2023, increasing by over 400%. Peru and Mexico are the two largest sources of U.S. fresh blueberry imports. Due to their competition, U.S. blueberry production has stagnated in recent years.”

REGIONAL IMPACTS

Growth in production from Peru and Mexico has hit growers in different regions of the United States. Imports from Peru mainly affect northern states, such as Michigan, while those from Mexico directly impact the Southeast, as they share the same market windows. The import volume from Mexico was only 25 million pounds in 2015, but it reached 140 million pounds last year, an increase of 460%.

“Florida production in 2015 was 25 million pounds, at the same level with Mexican imports, but it has been stagnating over the past decade due to the rapid growth in Mexican imports. In 2024, Florida production was only 28 million pounds. Its market share has shrunk dramatically and is now a fraction of Mexican imports.”

Over the past few years, there has been a year-round supply of fresh blueberries in the United States. This has been achieved by U.S. production and global imports. The constant supply of blueberries often squeezes grower prices in the Southeast when production regions overlap each other.

COSTLY LABOR

These factors make profitability a challenge for domestic producers. Sourcing affordable labor is one of the biggest problems. Most growers rely on the H-2A program to source labor. It is a costly program, making harvest the most expensive line item in production costs.

There have been some positive developments on the H-2A front in recent months. In late August, a federal court in Louisiana vacated the U.S. Department of Labor’s (DOL) 2023 Adverse Effect Wage Rate Methodology rule. Opponents of the methodology applauded the ruling, saying it brings a much-needed measure of wage stability for agricultural employers preparing for their upcoming season.

Also in August, the U.S. Department of Agriculture announced it would discontinue using the Farm Labor Survey (FLS). The FLS applied permanent, non-agricultural wage data to seasonal agricultural jobs and subjected growers to wage increases every six months.

Prior to August, the DOL announced plans to rescind the 2024 H-2A Worker Protection Rule, which would have added another layer of regulation and expense to the program.

While all these things are positive, they won’t offer much relief in the near term to the cost of using the H-2A program. Many growers are looking at automation and mechanical harvest to reduce their reliance on hand labor.

There’s no hard data on the amount of mechanical harvesting being deployed by fresh market growers, but ballpark estimates suggest about 30% of the crop in the Southeast is using this practice.

Kyle Hill, who runs a custom harvest business, says farms that are set up properly are harvesting up to 65% of their crop mechanically.

In addition, blueberry breeding programs have focused on development of new varieties suitable for mechanical harvest.

GROWING DEMAND

Besides reducing costs, domestic blueberry growers must continue to grow demand to keep prices up. That can come in various ways. Industry associations like the U.S. Highbush Blueberry Council (USHBC) focus on promotion as part of their mission. Currently, the USHBC is engaged in conversations about increasing its grower assessment to fund more promotion.

Individual farms and public breeding programs are developing blueberry varieties that deliver superior quality traits to draw consumer loyalty. Higher yields, larger sizes and desired fruit texture and taste are among the key targets.

Video Component

Click here to view a video on the digital edition of the Specialty Crop Grower Magazine.