By Frank Giles

The rapid pace of changes to the H-2A program continued in October when the U.S. Department of Labor (DOL) announced a new interim final rule that modifies the methodology for calculating the adverse effect wage rate (AEWR).

The interim rule was necessary because:

- The DOL lacked a mechanism to calculate the wage rate after a federal court in Louisiana vacated the 2023 AEWR rule.

- The U.S. Department of Agriculture announced it would no longer use the Farm Labor Survey in the AEWR calculation.

Agricultural industry associations welcomed the announcement as a step toward greater stability in the wages growers must pay to secure a legal and reliable workforce. The change aligns wage rates more closely with actual market conditions, moving away from artificially high rates that have strained fruit and vegetable growers. Those growers have seen double-digit percentage increases in the AEWR over the past few years.

“For years, our members have faced skyrocketing labor costs that threatened the viability of family farms in Georgia,” said Chris Butts, executive vice president of the Georgia Fruit & Vegetable Growers Association. “These new wage rules provide much-needed relief and help restore balance to the H-2A program. By aligning wages with real market conditions, growers can plan for the season with greater certainty.”

Understanding Worker Levels

The new rule introduces two skill-based wage categories within each occupational classification to account for differences in duties and qualifications, ensuring fair compensation while providing flexibility for employers. Additionally, H-2A employers who provide housing will be eligible for a downward adjustment in their AEWR.

- Level 1 (Entry-Level/Less Experienced): Typically includes workers performing standard agricultural tasks with minimal prior experience. This category accounts for the majority of field and livestock positions.

- Level 2 (Experienced/Higher Skilled): Includes workers with specialized skills, greater experience or responsibilities requiring additional training or certification. Employers may offer higher wages to reflect these qualifications.

New Wage Rates

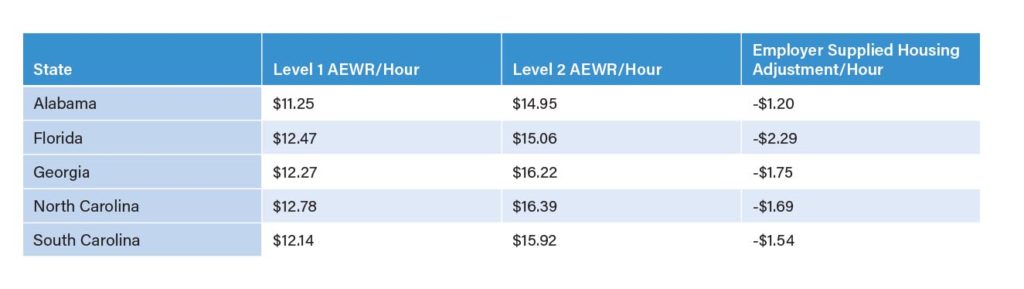

The new AEWR for Southeastern states varies, because states are treated individually (no regional rate). The rates in the table are for the field and livestock workers combined category. A standard downward adjustment is applied to account for employer-provided free housing (based on HUD Fair Market Rents for a four-bedroom unit, capped at 30% of the AEWR). Employers must pay the higher of the AEWR or other applicable wages (e.g., state minimum) and adjust upward if a future AEWR increase occurs during a contract.

Timing

The new rule was set to go into effect on Oct. 2 when the rule was published in the Federal Register with comments being accepted for 60 days after publication. Existing H-2A contracts are subject to the wage rates outlined in those contracts, not the new rate.

It is expected that the DOL will receive many comments on the new AEWR methodology both in favor and opposition. Questions remain about how the DOL will assign different job tasks (e.g. Level 1 vs. Level 2). This would impact the wages employers are required to pay.